Good for me, bad for US

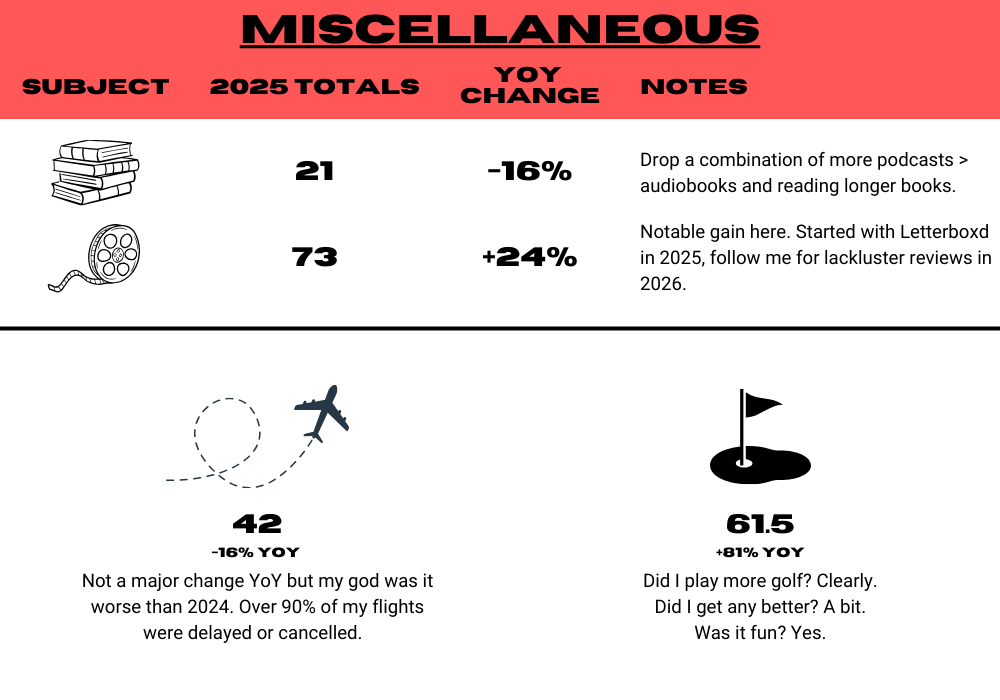

What a time to be alive 2025 was, eh? While the media made it seem like the world was falling apart brick by brick over the course of the year, my year was pretty darn okay. I got engaged (shoutout CCFerg), Crystal Palace won the FA cup for the first time ever, my family & friends are all healthy, I traveled a lot, played golf with new & old friends, and plenty of good food.

It’s hard to believe that 2026 will be my 5th year of recordkeeping. I’ll finally have five years of data across the various things I track—how exciting!

As always, I’m grateful to you, dear reader, for perusing my yearly recaps. Let me know what else I should keep track of, what I should watch, what I should read, etc.

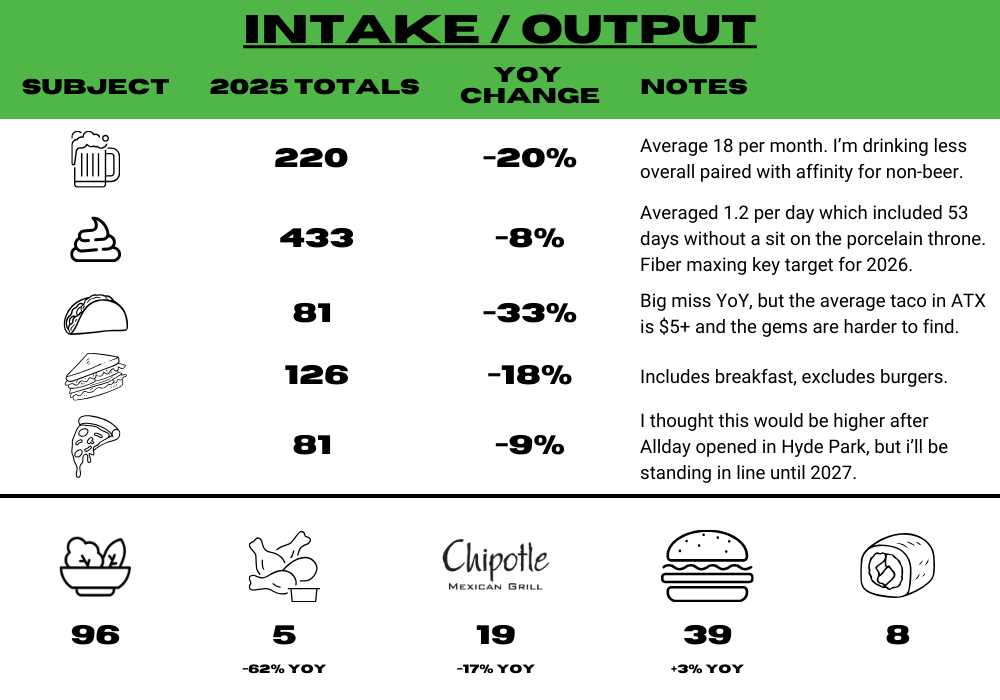

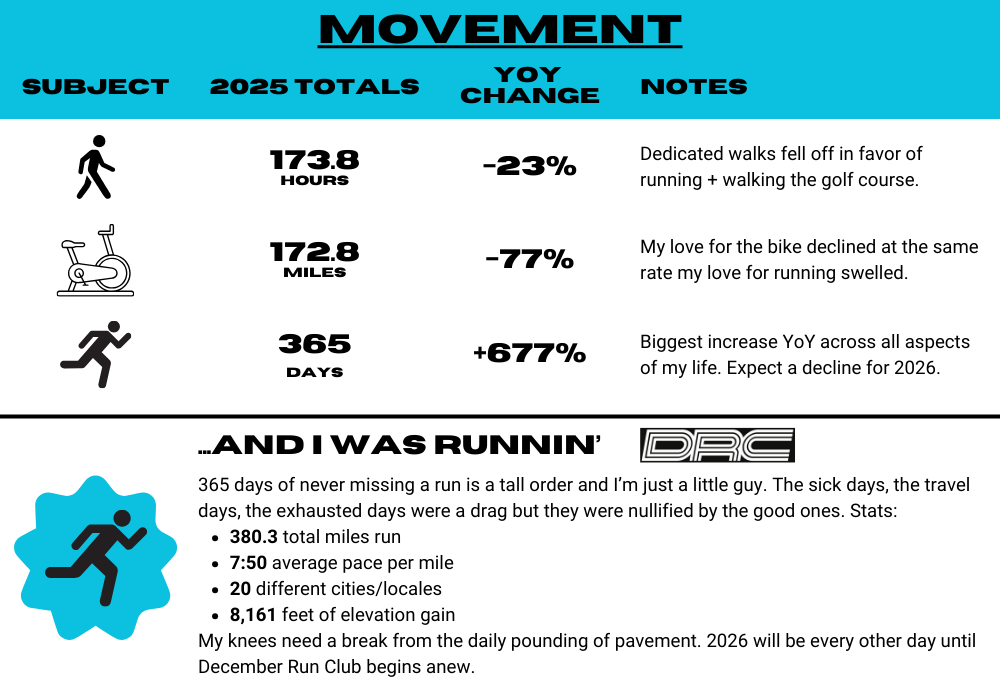

By the Numbers

Reading List

Recommendations: Lonesome Dove, Every Man for Himself and God Against All, Friday Night Lights

Vandermeer, Jeff Acceptance

Akbar, Kaveh Martyr!

Sriduangkaew, Benjanun And Shall Machines Surrender

Tchaikovsky, Adrian Cage of Souls

Miller, Candice The River of Doubt

Ahamad, Liaquat Lords of Finance

Cox, Joseph Dark Wire

King, Stephen Holly

King, Stephen The Shining

King, Stephen Dr. Sleep

Dell, Michael Play Nice but Win

Herzog, Werner Every Man for Himself and God Against All

Morell, Michael The Great War of Our Time

King, Stephen Never Flinch

Frost, Mark The Match

Bissinger, Buzz Friday Night Lights

Garland, Alex The Beach

Eisinger, Jesse The Chickenshit Club

Blas, Javier; Farchy, Jack The World for Sale

Galbraith, Robert The Hallmarked Man

McMurtry, Larry Lonesome Dove

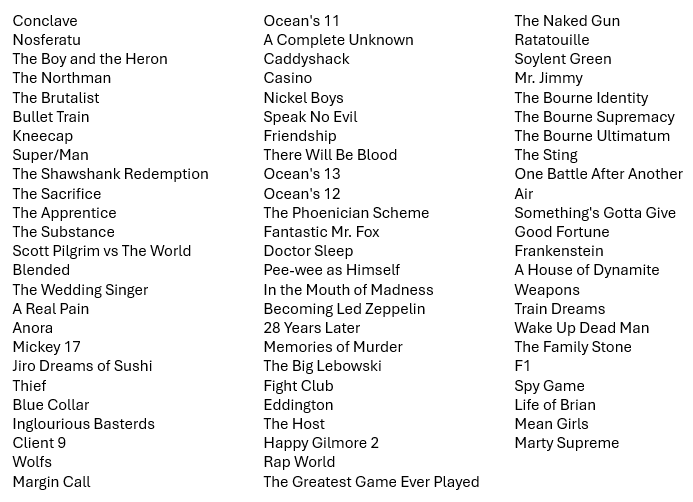

Movies

Recommendations: Train Dreams, Memories of Murder, Nickel Boys

Quotes

“Practicing an art, no matter how well or badly, is a way to make your soul grow, for heaven's sake. Sing in the shower. Dance to the radio. Tell stories. Write a poem to a friend, even a lousy poem. Do it as well as you possibly can. You will get an enormous reward. You will have created something.” -Kurt Vonnegut

“Everyone wants a village, but no one wants to be a villager. Being annoyed is the price we pay for connection and community. We’re paying for convenience with disconnection. We traded the messiness of community for the ease of solitude and lost something vital along the way.” - Anon

“The performance of certainty seemed to be at the root of so much grief. Everyone in America seemed to be afraid and hurting and angry, starving for a fight they could win. And more than that even, they seemed certain their natural state was to be happy, contented, and rich. The genesis of everyone’s pain had to be external, such was their certainty. And so legislators legislated, building border walls, barring citizens of there from entering here. ‘The pain we feel comes from them, not ourselves’ said the banners, and people cheered, certain of all the certainty. But the next day they’d wake up and find that what had hurt in them still hurt.” - Kaveh Akbar

“We’re squandering some of our advantages versus other countries: greater productivity, greater influence culturally, intellectually, and politically. We’re transforming the rule of law into ‘an instrument of vengeance’, dismantling the US government, attacking scientific research and university independence, waging war on reliable statistics, showing hostility toward immigrants, rejecting medical and climate science, rejecting basic economics of trade, picking Putin over Zelensky, and showing contempt for alliances and institutions of cooperation.” - Martin Wolf

Notes

Every week, I read The Economist along with Sandy Leeds’ weekly newsletter and compile the tidbits that pique my interest. After sorting through ~30 pages of notes from 2025, my notes coalesced around the following topics & themes.

Media, Tech, and Isolation

“Everyone wants a village but no one wants to be a villager. Being annoyed is the price we pay for connection and community. We’re paying for convenience with disconnection. We traded the messiness of community for the ease of solitude and lost something vital along the way.”

“Willpower alone is unlikely to defeat perfectly tuned distraction machines with algorithms that constantly adjust to maximize user engagement. The environment is hostile.”

Taxes Taxes Taxes

Over the last 50 years, the economy performed best during the Clinton presidency, which saw 3.9% real annual growth, robust wage increases, and booming private investment. Notably, this economic success followed tax increases, not tax cuts.

The major tax cuts in 1981, 2001, 2003, and 2017 increased deficits, produced uneven economic results, and delivered their largest benefits to wealthy Americans.

The wealthiest 1% of households saved $47,147 from the Reagan cuts, $39,038 from the Bush cuts, and $31,704 from the Trump cuts.

Middle-income households, however, saved just $695, $2,372, and $879, respectively. In each case, the wealthiest Americans received tax cuts 16 to 68 times larger than those received by ordinary Americans.

Federal Deficit

The US national debt exceeds the size of the economy.

US public debt as % of GDP: 32% in 2005, 70% in 2015, 100% in 2025, ~125% by 2035.

Approximately 20% of tax revenue is used to pay interest.

Employment

2024 total job gains 2.7M of which 1.9M (70%) were foreign-born workers.

Nearly 1M job cuts announced across the US economy in the year to date (H1), about 50% higher than the same point last year. Hiring rates have fallen to their lowest point in a decade, excluding the pandemic period. More than 25% of the unemployed have been without work for at least 6 months–a level rarely seen outside of recessions.

Small businesses account for more than 80% of US employment and CapEx. Small businesses (<500 employees) collectively employ about half of America’s private workforce.

Healthcare

The US spent more than $4.5T on healthcare in 2024. It is estimated to soon reach 20% of GDP.

Healthcare spending increased 7.5% YoY in 2023 to $4.867T ($14,570/person). This was the fastest pace since 1990. Hospitals took in $1.5T in fees in 2023–triple the amount spent on medication and 1/3rd of America’s healthcare spend. Even on a per-capita basis, other large, rich nations spend about half as much as the US. It is the largest component of US consumer spending on services.

Over the past 20 years, medical care (visits to doctors, hospital stays, prescription drugs, medical equipment) prices have risen nearly 40% faster than overall inflation. Since 2000 hospitals’ prices have soared 250%

Mergers have brought the benefits of scale to the hospital industry, but little of that has been passed on to patients. PE firms own less than 10% of America’s 6,000 hospitals.

To qualify for Medicaid, patients have to provide copious amounts of data, listing all aspects down to the mileage on their car and any burial plots they own. Medicaid covers anyone making less than $21,000–it now covers 72M Americans.

Oil!

In 2024, US oil production averaged 13.2M barrels a day, making it the largest producer of oil in the world. This is 2.5x 2008 production.

Trump wants lower oil prices to lower inflation (and enable the fed to lower rates) and to pressure Russia. However, the US shale industry is focused on investor returns: buybacks and dividends rather than new drilling capacity.

Breakeven prices for new drilling projects ranged from $59-$70 in 2024. A recent KC Fed survey found that average US oil price needed for a substantial increase in drilling was $84 a barrel.

Saudi Arabia needs $90 oil to balance its 2025 budget.

In a Dallas Fed survey, US shale producers criticized Trump’s energy policy, describing it as chaotic and destabilizing for the industry. They complained that it is unprofitable to drill for oil if the price is below $60. The Dallas Fed survey found that drilling activity in the southwestern US dropped 6.5% in Q3 after dropping 8.1% in Q2. The negative outlook for the industry nearly tripled to 17.6%. Tariffs on steel and aluminum are also hurting the industry. Some executives argue that the administration doesn’t understand the industry and is effectively aligned with OPEC.

When stocks or other assets move from geopolitical events, the move often (eventually) reverses.

For example, after 9/11, Brent crude prices rose 5% due to the risk that war in the middle east would disrupt supplies. But the price of oil was down by 25% within 14 days as fears that a slowing global economy would weaken demand.

Similarly, Brent prices rose by 30% after Russia invaded Ukraine. But the price of Brent was back to its pre-invasion levels eight weeks later.

Mr. Trump’s nostalgia for fossil fuels ignores the potential of renewables to make energy much more abundant. That is foolish when the race for AI is in part a race for the electricity necessary to train massive models.

Equities & Market Conditions

Ownership, Wealth, and Volumes

In 1989, only 3% of the poorest 20% of households held stocks (according to the Fed). By 2022, 17% did. The share of average earners with stock holdings rose from 29% to 60% over the same period.

US households hold a record 52% of their wealth in stocks. The top 20% of earners in the US now own 87% of all stocks and mutual funds. Household wealth is nearly six times GDP, a record high, meaning any fall would be painful.

Over the past five years, the number of shares traded each day in the US has risen by 60% to 18B. Approximately 9% of equity market trades now take place outside of official market hours (up from less than 1% six years ago).

Concentration

The US now accounts for 64% of global equity market value, up from 40% after the 2008 crisis. The S&P 500 has delivered average annual returns of 14% since 2010.

Just 26 stocks now account for half the entire value of the S&P 500. This is down from 36 at the end of 2023. The top five stocks now comprise more than 27% of the S&P 500. This is the highest since 1964. Back in 1964, the top five were more diversified.

Outlook

We’re seeing stocks rise and the dollar fall. Investors are bullish on the prospects of US companies, but bearish on the US economy.

Operating and net margins are their highest level in 20 years. Analysts estimate that they will continue to increase. But one survey of 9,000 companies indicates that margins will shrink–even though revenue will grow, expenses will grow faster.

The forward P/E is currently higher (~23) than at any time except March 2000 (peak of the internet bubble). The five-year pre-pandemic average P/E of the S&P was closer to 17. During recessions since 1980, the average has been closer to 10.

The CAPE is very close to 40, surpassed only by brief months in 1999 and 2000. High valuations (like we have now) correlate with poor subsequent returns. Corporate taxes can’t get much lower, labor’s share of GDP is low, and we have massive federal deficits.

Believe it or not, calls.

Trade, Tariffs, and Turbulence

“Trump has a pronoun problem. He keeps saying he’s imposing tariffs on they/them. But he’s actually imposing them on us.” - Justin Wolfers

Even before Trump’s term, 75% of American industries had become more concentrated than they were in the highly competitive era of the 1990s computer boom, exercising a drag on productivity. Fewer startups now challenge entrenched incumbents. America ultimately regained its technological edge not through isolation but by embracing global economic integration.

Less than 1 in 10 Americans works in manufacturing. The US has nearly 500,000 unfilled manufacturing jobs.

The idea of reducing bilateral trade deficits to zero is economically illiterate. Think about this on a personal level. If you have a housekeeper, you have a trade deficit with this person. You are not a victim in this trade. You employ the housekeeper because this is cheaper than using your time to do the work yourself.

AI - Where’s the ROI

Total revenues accruing to the leading AI firms will be $50B in 2025. Although revenues are growing fast, they pale in comparison to the $2.9T cumulative investment in new data centers globally. Five companies alone have done CapEx worth 1% of US GDP. Big tech firms are set to invest $5T between now and 2030.

Bain & Co estimates that the wave of AI infrastructure spending will require $2T in annual AI revenue by 2030. That is more than the combined 2024 revenue of Amazon, Apple, Google, Microsoft, Meta, and Nvidia, and more than five times the size of the entire global subscription software market.

The last two nuclear reactors built in the US each generate 1.1GW of power. The reactors were originally budgeted at $14B over eight years. The final tally exceeded $30B and they took 15 years to build. There’s a lot of talk about small modular reactors, but none have been built and there are no plans to build one.

AI - Clever Accounting

The big five tech companies do not report the net book value of their computing infrastructure.

You can get a rough idea by multiplying the gross value by the ratio of net book value to book value of all plant & equipment (excluding land).

Next, assume that half the resulting sum is tied up in servers, in line with their share of the global AI capital binge. If all these servers lose their value in three years rather than what every company assumes, their combined annual pre-tax profit would fall by $26B, or 8% of last year’s total.

At the five companies’ current ratio of market capitalization to pre-tax profit, this would amount to a $780B knock to their combined value. Redo the server depreciation to two years and the size of the hit is $1.6T.

AI - Outlook

McKinsey has found that the success rate of pilot AI projects in firms it has canvassed is less than 15%.

Increased competition could result in lower margins for chip designers

If OpenAI is no longer seen as the leader for LLMs, they could have trouble with funding, and this could impact all of the companies they have contracted with.

Credit investors are increasingly focused on the risk that the AI build out could prove over financed relative to its ultimate cash flows. These projects could be exposed to overinvestment, operational outages, or client churn. Wall Street is financing a massive CapEx cycle in AI infrastructure.

Fear could increase among investors. Goldman Sachs’ clients are pulling back their bullish views on AI and US stocks. Their poll of 782 institutional clients showed much lower expectations for 2026.

OpenAI

OpenAI has committed to ~$60B annually in computing capacity from Oracle, $18B for a data center venture, and $10B for customized chips. This is from a company with $13B in revenue and expected losses of $44B through 2029.

From 2023 to 2030, OpenAI’s expected cash burn rate could reach $115B. They had $13B in revenue in 2025.

OpenAI now has deals to build 16GW of data centers at a cost of $750B. They have also committed to buying $300B of cloud computing services from Oracle over the next five years. This brings us to $1T of spending. That is 3.4% of 2024 US GDP and approximately a quarter of all nonresidential private investment.

Some $100B of the spending will come from NVDA. They’ll also get some funding from Oracle and Softbank. But they’ll still need $800B. Over the last 45 years, tech IPOs have raised a total of $600B inflation-adjusted dollars. From 1995 to 2000, total tech proceeds came to $209B.

Circular deals could hide a lack of demand and could result in a chain reaction if one company fails.

Oracle

Oracle has $82B of debt and will borrow $25B per year for the next four years. Their debt to equity ratio is 450%.

For perspective, $50B of CapEx = 75% of Oracle’s revenue (they had averaged CapEx equal to 17% of revenue over the past five years).

Oracle expects $4B of additional revenue from bookings, but not until fiscal 2027.

While Oracle has a large backlog of business ($523B), there’s concern about how they’ll raise the money to build these data centers. Investors are very nervous that $300B of the backlog is to provide AI computing services to OpenAI, a company that generates less than $20B in annual revenue. One analyst suggests that OpenAI would need to grow to more than $300B of annual revenue in 2030 to justify the spending envisioned in the Oracle contract. Oracle is doing a lot of building for just one customer (OpenAI).

Remaining Performance Obligations (RPOs) represent contracted sales that have yet to be recognized as revenue. Management believes these sales are probable, not definite. Oracle now has $523B of RPOs, of which $300B is with OpenAI. OpenAI has $1.4T of commitments over the next eight years.

random stats

Of the 50 fastest men’s marathon times, only 9 predate 2017.

771,000 homeless Americans, the highest on record, and an 18% increase YoY

Spending on corporate lobbying has increased 66% since the 1990s, increasing regulatory capture and weakening antitrust enforcement.

Sales of the bible were up 22% in the US in 2024.

Immigrants make up 20% of residents in California, Texas, Florida, and New York

American’s Failure of Imagination

They cannot imagine a system other than unrestrained capitalism

They cannot imagine that other countries are just as good (or better) than America

They cannot imagine that anything truly bad will happen to anyone truly good

They cannot imagine a world where being less individualistic doesn’t feel like losing

In Memoria

Outer Heaven